Delete - new partnership page

partnership

Partnership Opportunities

Enhance your brand at the industry's most credible event

Enhance your brand at the industry's most credible event

Embark on a journey of unparalleled opportunities at the Risk Live events. Connect with senior decision-makers and prominent risk professionals, participate in enriching discussions, and ignite lead generation. Join us to broaden your network, establish thought leadership, and foster strategic partnerships.

Spanning three content-driven stages, the event offers a comprehensive view of the risk management landscape. Our audience tackles challenges such as digital transformation, data management, cyber threats, regulatory changes, and AI integration. Showcase your solutions to empower seize the opportunity to spotlight your solutions, empowering them in overcoming these hurdles.

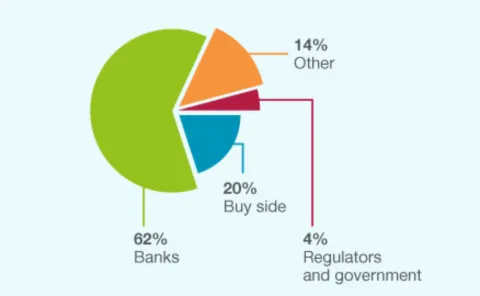

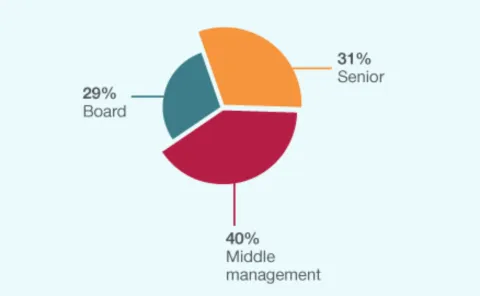

Our audience

Industry breakdown

Seniority breakdown

Companies attending FX Markets events

Founded in 1869, Goldman Sachs is a leading global investment banking, securities and investment management firm. Headquartered in New York, it maintains offices in all major financial centres worldwide.

BNP Paribas is a leading bank in Europe with an international reach. It has a presence in 74 countries, with more than 192,000 employees, including more than 146,000 in Europe. The Group has key positions in its three main activities: Domestic Markets and International Financial Services and Corporate & Institutional Banking, which serves two client franchises: corporate clients and institutional investors. The Group helps all its clients to realise their projects through solutions spanning financing, investment, savings and protection insurance.

Fully integrated in the BNP Paribas Group, BNP Paribas Corporate and Institutional Banking (CIB) is a leading provider of solutions to two client franchises: corporates and institutionals, and operates across EMEA, APAC and the Americas. The bank is a global leader in Debt Capital Markets and Derivatives. It is a top European house in Equity Capital Markets and it has leading franchises in Specialised Financing. In Securities Services, it is a top five house worldwide.

HSBC is a financial services organisation that serves more than 40 million customers, ranging from individual savers and investors to some of the world’s biggest companies and governments. Its network covers 64 countries and territories, and its expertise, capabilities, breadth and perspectives open up a world of opportunity for its customers. HSBC is listed on the London, Hong Kong, New York, Paris and Bermuda stock exchanges.

Credit Suisse AG is one of the world's leading financial services providers and is part of the Credit Suisse group of companies. As an integrated bank, Credit Suisse is able to offer clients its expertise in the areas of private banking, investment banking and asset management from a single source. Credit Suisse provides specialist advisory services, comprehensive solutions and innovative products to companies, institutional clients and high net worth private clients worldwide, and also to retail clients in Switzerland. Credit Suisse is headquartered in Zurich and operates in over 50 countries worldwide. The registered shares (CSGN) of Credit Suisse's parent company, Credit Suisse Group AG, are listed in Switzerland and, in the form of American Depositary Shares (CS), in New York.

Further information about Credit Suisse can be found at www.credit-suisse.com

Pictet Asset Management is a specialist asset manager offering investment solutions and services to investors around the world.

Today we manage USD 193 billion of assets across a broad range of equity, fixed income, alternatives and multi-asset strategies.

Our mission is to build lasting partnerships with our clients by exceeding their expectations for investment performance and service. Our clients include some of the world’s largest pension funds, sovereign wealth funds and financial institutions.

We have over 890 employees spread across 17 offices worldwide including 7 investment centres (Geneva, Zurich, London, Milan, Singapore, Tokyo and Hong Kong).

We are part of the Pictet Group, founded in Geneva in 1805, which also specialises in Wealth Management and Asset Services. Privately owned and managed by seven partners, the Pictet Group has more than 4,000 employees in 27 offices around the world.

All data as of 30 September 2018

Why partner with Risk Live

-

Meet the Risk.net community in person

-

Position your organisation as a revolutionary thinker

-

Reach senior decision makers looking for answers

-

Access the network of Risk.net Subscribers before, during and after the event

-

Benefit from Risk.net’s experience of delivering thought leadership and senior decision maker audiences for our event partners for more than 25 years

Key themes included

Regulatory outlook: effective risk metrics across different jurisdictions

TEST

Tackling AI risk

TEST

Risk management in the era of sustained inflation

TEST

Banking and AI in 2024:

Clearing, margin and collateral

Clearing, margin and collateral

Legacy Libor / SOFR evolution

Legacy Libor / SOFR evolution

Basel III capital / FRTB

test

Electronic trading

test

Volatility investing

- Volatility investing

Speaker

Victoria Cumings

Managing Director, Americas, FX Division

Global Financial Markets Association (GFMA)

Victoria Cumings is the Americas representative of the Global Foreign Exchange Division (GFXD) of the Global Financial Markets Association (GFMA). Since its establishment, the GFXD has grown to 24 members, between them accounting for over 90% of the global FX market, and is represented in Europe, North America and Asia. The GFXD works with key regulators, Central Banks and other interested parties to monitor policy and regulatory developments that could affect the FX markets and seeks to ensure the establishment of harmonised regimes and infrastructure to enable an effective market for all participants.

Victoria is responsible for regulatory issues in the Americas and for a number of global GFXD topics, in areas including capital, margin and clearing. Victoria is also a former attorney and has previously held positions at CLS Bank, HSBC, Davis Polk, and McCullough Robertson.

Conception Alonso

Head of section, international markets

European Central Bank

Conception Alonso is the head of the International Markets Section in the Directorate General Market Operations at the ECB.

She has been working at the ECB since its inception where she first worked as economist in the Directorate General International Relations. She joined the Directorate Market Operations in 2004 and was involved in the implementation of monetary policy. From 2007 to 2016, she has primarily focused on the design and the implementation of non-standard monetary policy measures (fixed rate full allotment policy, longer term refinancing operations) and in particular the assets purchase programmes (ABSPP, CBPP3 and CSPP). She is heading the International Markets Section since November 2016 and is responsible for FX related matters, market intelligence in several market segments and the management of the ECB’s foreign reserves.

David Page

Head of macroeconomic research

AXA Investment Managers

David Page is head of macroeconomic research at AXA Investment Managers. He manages a global team of 10 economists and strategists, is a regular guest on Bloomberg TV and other global media. Page joined AXA Investment Managers in July 2014 as a senior economist to provide economics coverage on US and UK economies. He has written extensively on the US economy, covering elections, fundamental monetary policy debates and issues of fiscal stimulus. Before joining AXA Investment Managers, Page worked for four years at Lloyds Bank Commercial Banking as a senior economist, primarily covering the UK economy. During this time, he was twice voted the top forecaster in the region in 2011 and 2012 (and came third in 2013). Prior to this, Page worked for 10 years at Investec Bank as a global economist, primarily covering the UK and European economies. Before this, he spent five years in the Government Economic Service, initially working for the energy regulator before joining the UK Debt Management Office – an executive agency of HM Treasury – at its inception in 1998, considering issues of primary issuance for the UK gilt market. Page holds a masters of science degree in economics from the University of Warwick, UK and a bachelor's degree in Economics from the University of York.

Asif Razaq

Global head of FX algo execution

BNP Paribas

Asif Razaq is an experienced foreign exchange algo trader with over 15 years of experience developing electronic trading platforms. He has a masters of science degree in artificial intelligence (AI) and joined BNP Paribas from Citi, where he worked on various initiatives including e-FX pricing engines and algorithmic trading. Utilising his experience in AI, Razaq developed and launched Cortex iX, a cutting-edge FX algorithmic execution platform that has been highly acclaimed by clients and industry experts globally.

Ralf Donner

Head of FICC execution strategies

Goldman Sachs

Ralf Donner is Head of FICC Execution Strategies at Goldman Sachs. He is responsible for the firm’s client FICC algorithmic execution offering, pre- and intra-trade liquidity and transaction cost analytics, and post-trade reporting.

Ralf started his professional career at ABN Amro in 2006 as an FX options quant, followed by 8 years with Morgan Stanley in London and New York, first in model validation of options pricing models and then in quant sales, focusing on systematic FX trading strategies and FX market microstructure. From 2014-2016 he ran Morgan Stanley’s QSI team in New York.

Ralf holds a Masters in Physics and a Doctorate in Theoretical Physics from Oxford University.

Sebastjan Smodis

Emea chief risk officer and global head of investment risk - managing director

UBS

Chris Knight

Group chief risk officer

Legal and General

Chris Knight took the role of group chief risk officer in May 2021. For the previous three years he had been the chief executive of Legal and General’s retail retirement business, where he led the expansion of annuity propositions, developed one of the leading providers of lifetime mortgages and launched their financial advice and care businesses. Knight also serves as Legal and General’s customer champion, representing retail customers’ interests across the whole product range, a perspective he brings to his chief risk officer role.

He has previously held positions at Legal and General of finance director of the international division, and chief financial officer of Legal & General Assurance Society. Knight has a first-class economics degree from King’s College, Cambridge and has worked on four continents in a career spanning more than three decades. He is a fellow of the Institute and Faculty of Actuaries.

Nick Silitch

Former chief risk officer

Prudential

Renato Zaffuto

Global chief investment officer

Fideuram Investments

Renato Zaffuto

Head of Investment Solutions

Fideuram Asset Management

Managing Director at Fideuram Asset Management UK since March 2020.

Chief Investment Officer at Fideuram Investments from 2016 to 2020.Responsible for equites at Fideuram Asset Management Ireland from 2014 to April 2016.

Previously he held senior positions at ABN AMRO Asset Management SGR, Banca MPS, Capitalgest SGR (Gruppo UBI), IMI-Fideuram Asset Management and Unicredit.

Graduated with honours in Economics and Business Administration from Pavia University, where he also earned a Masters Degree in Finance and Control. He is Chartered Accountant, Financial Auditor and registered with the Register of Financial Advisors.

Nick Stansbury

Head of climate solutions

Legal & General Investment Management

Nick joined in 2013 as a Fund Manager in LGIM’s Global Equity team, focused on energy and natural resources. Prior to joining LGIM he was an Investment Director for Developed Asia and Global Emerging Markets at Standard Life Investments. He previously worked for an emerging market focused hedge fund investing in equities, convertible bonds and distressed debt. He has also worked in a corporate advisory role and as a software developer. Nick has a law degree (LLB.) and a Master’s in jurisprudence (MJur.), focused on securities law, from the University of Durham.

Robert Allard

Chief investment officer

Rothesay Asset Management

Rob Allard is the Chief Investment Officer and Head of Rothesay Asset Management in North America. With over 20 years of experience in structured finance, Rob joined Rothesay Asset Management in 2018 to build and run the investment portfolio in North America. Prior to his current roles, Rob was the founding partner and CEO of Firebreak Capital, as well as Managing Director, Head of Structured Product Sales at Goldman Sachs and Deutsche Bank. He is currently studying part-time at Harvard to obtain his Masters in Sustainability and he currently holds a graduate Certificate from Harvard in Corporate Sustainability and Innovation and a Certificate from Harvard Business School in Sustainable Business Strategy.

David Carlin

Climate risk lead

UN Environment Programme Finance Initiative

David Carlin is an acknowledged authority on climate change and its implications for the financial system. He is the founder of Cambium Global Solutions, an advisor to governments, corporates, and financial institutions on climate and ESG topics. Carlin has authored numerous reports that provide practical tools for financial actors looking to address climate change and has run capacity-building programs for financial institutions and supervisors around the world.

He is the head of climate risk and task force on climate-related financial disclosures (TCFD) for the UN Environment Programme’s Finance Initiative (UNEP FI). Over the past years, he has worked with over 100 global banks, investors, and insurers on climate scenarios, climate risk assessments, and climate governance.

Carlin is an advisor to UNEP FI’s task force on nature-related financial disclosures (TNFD) pilot program on nature and biodiversity related risks as well as the net-zero banking alliance (NZBA). He has also been a technical advisor to the Glasgow Financial Alliances for Net Zero (GFANZ), is a contributor to Forbes and a senior associate at Cambridge’s Institute for Sustainability Leadership (CISL).

He has worked as a principal in finance, risk, and public policy for Oliver Wyman and in model risk management for PNC Bank. Carlin's background is in quantitative modeling and decision science.

Nitesh Patel

Group operational risk director

Lloyds Banking Group

Nitesh is the group operational risk director at Lloyds Banking Group. Nitesh joined LBG in 2022 from Credit Suisse where he had an extensive audit career most recently as chief auditor for technology, operations, change and third party risks. Nitesh has over 20 years of operational risk experience, including control design, risk culture and use of emerging technology.

On a personal level, he has a love of travel, football and also spends some of his time helping local charities.

Chris Callies

Interim CIO/CRO

Global Financial Firms

Chris Callies has partnered with senior officers of major financial institutions to address growing complexity in the nature of financial risk and its propagation across geographic, asset class, market structure, and operational boundaries. After initially working with institutional asset managers, commercial and investment banks, and multi-family offices through the financial crisis that began in 2007–08, her professional domain later expanded to alternatives managers, insurance firms, non-bank lenders and regulators. Callies has advanced through a series of senior roles at Credit Suisse, Merrill Lynch and Bessemer Trust, including chief investment strategist, chief strategist, head of market risk strategy, and acting chief investment officer, with oversight of more than $40 billion in traditional and alternative assets. She is a dedicated advocate for fully integrated, flexible, proactive risk analytics as a vital tool for effective capital planning, product development and sustainable returns. Callies holds a bachelors degree from Northwestern University in Evanston, Illinois, with a sub-specialty in advanced applied mathematics.

Zachery Halem

Director of the Lazard Climate Center

Lazard

Zachery Halem is the Director of Lazard’s Climate Center. In this capacity, he researches and advises clients on climate transition related matters, including climate risk quantification and mitigation, carbon abatement measures, structuring green or ESG-linked securities, and carbon offset markets. He previously served as a researcher in MIT’s Laboratory for Financial Engineering, where he employed securitization models to finance emerging sustainable and energy-efficient technologies, such as nuclear fusion. He has also started companies in the payment processing and drone space. He holds a B.S.E. (with high honors) in operations research and financial engineering from Princeton University, and a S.M. in operations research from MIT.

Previous sponsors

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration.

Milliman is among the world’s largest providers of actuarial, risk management, and related technology and data solutions. With over 60 offices around the globe, our consulting and advanced analytics capabilities encompass the fields of healthcare, property and casualty insurance, life insurance, financial services, and employee benefits. Our breadth of expertise and data solutions provide insight into the interplay between physical, health, and economic risks, as well as the ability to communicate those risks and inform key decisions for governments, communities, and businesses around the world.

Founded by a group of industry experts, ActiveViam understands the data analytics challenges faced by financial institutions across trading desks, risk, and compliance. That is why we pioneered the use of high-performance analytics in finance, helping the largest investment banks, asset managers and hedge funds make better decisions, explain results with confidence, and simulate the impact of their decisions.

Our mission is to deliver train-of-thought analysis on terabytes of data in the most cost-effective way so our customers can explain their results with confidence and model the scenarios that will optimize their business. We are a pure player specializing in risk data analytics for one of the fastest moving and most regulated industries with a presence in the world’s leading financial marketplaces: London, New York, Singapore, Sydney, Hong Kong, Paris, and Frankfurt.

ActiveViam are also the proud winners of the Best use of cloud and FRTB product of the year at the Risk Market Technology Awards 2024.

For more information please visit: www.activeviam.com

We empower institutions in financial markets to seize opportunities amidst uncertainty by delivering unparalleled accuracy, transparency, and innovation through our industry-leading expertise in quantitative analytics and cutting-edge technology.

S&P Global Market Intelligence integrates financial and industry data, research and news into tools that track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuation and assess credit risk. It offers investment professionals, government agencies, corporations and universities the intelligence essential to make business and financial decisions with conviction.

Moody’s Analytics provides financial intelligence and analytical tools to help business leaders make better and faster decisions. Its risk expertise, expansive information resources and innovative application of technology help its clients confidently navigate an evolving marketplace. Moody’s Analytics offers industry-leading and award-winning solutions, made up of research, data, software and professional services.

Clarity AI is a sustainability technology platform that uses machine learning and big data to deliver environmental and social insights to investors, organizations, and consumers. Clarity AI’s capabilities are an essential tool for end-to-end sustainability analysis related to investing, corporate research, benchmarking, consumer ecommerce, and regulatory reporting. As of January 2023, Clarity AI’s platform analyzes more than 70,000 companies, 360,000 funds, 198 countries, and 199 local governments, which represents the broadest data coverage in the market with up to 13 times more than other leading players. One way Clarity AI delivers on its mission to bring societal impact to markets is by ensuring its capabilities are delivered directly into clients' workflows through integrations with partners like BlackRock - Aladdin, Refinitiv an LSEG business, BNP Manaos, Allfunds, and Simcorp. Additionally, Clarity AI's sustainability insights reach more than 150 million consumers across more than 400,000 merchants on the Klarna platform. Clarity AI has offices in North America, Europe, and the Middle East, and its client network manages tens of trillions in assets for companies like Invesco, Nordea, PGIM, Santander, Wellington, and BNP Paribas. clarity.ai

FactSet helps the financial community to see more, think bigger, and work better. Our digital platform and enterprise solutions deliver financial data, analytics, and open technology globally. Clients across the buy-side and sell-side as well as wealth managers, private equity firms, and corporations achieve more every day with our comprehensive and connected content, flexible next-generation workflow solutions, and client-centric specialized support. As a member of the S&P 500, we are committed to sustainable growth and have been recognized amongst the Best Places to Work in 2023 by Glassdoor.

Coherent provides easy-to-use data pipelines that allow back-end developers to build data back-ends, including machine learning pipelines and indexers. Its datasets provide data points for indexing and creating models

KWA Analytics is a consultancy with a focus on and experience in implementing trading, risk and treasury management solutions. It is experienced in implementations, upgrades and solution architecture across a range of organisations, and has established itself as a trusted implementation consulting services provider.

SAS is a global leader in AI and analytics software, including industry-specific solutions. SAS helps organizations transform data into trusted decisions faster by providing knowledge in the moments that matter. SAS helps clients across industries address their most critical and complex analytical challenges through SAS Viya, our cloud-native AI, analytic and data management platform.

From helping our customers fight fraud and mitigate risks through our fraud, anti-money laundering, security intelligence and risk management solutions, as well as helping drive engagement through our customer intelligence solutions, SAS delivers innovative solutions to enable our customers achieve greater productivity, performance and trustworthiness.

MSCI is a leading provider of critical decision-support tools and services for the global investment community. With over 50 years' expertise in research, data and technology, MSCI powers better investment decisions by enabling clients to understand and analyse key drivers of risk and return, and to confidently build more effective portfolios. MSCI creates industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

Quantifi is a provider of risk, analytics and trading solutions. Its award-winning suite of integrated pre- and post-trade solutions allow market participants to better value, trade and risk manage their exposures. Founded in 2002, Quantifi is trusted by the world’s most sophisticated financial institutions, including five of the six largest global banks, two of the three largest asset managers, leading hedge funds, insurance companies, pension funds and other institutions across 40 countries. By applying the latest technology innovations, Quantifi provides new levels of usability, flexibility, and integration. This translates into dramatically lower time to market, lower total cost of ownership and significant improvements in operational efficiency, allowing clients to focus on their core business.

ServiceNow makes the world work better for everyone. Our cloud-based intelligent platform helps digitise and unify organisations to drive smarter, faster ways to address evolving risks, vulnerabilities, and compliance challenges. Power your resilient enterprise with risk-informed decisions embedded in daily work. Connect the business, security, and IT to manage risk and resilience in real time.

As society redefines risk and opportunity, OneTrust empowers tomorrow’s leaders to succeed through trust and impact with the Trust Intelligence Platform. The market-defining Trust Intelligence Platform from OneTrust connects privacy, GRC, ethics, and ESG teams, data, and processes, so all companies can collaborate seamlessly and put trust at the center of their operations and culture by unlocking their value and potential to thrive by doing what’s good for people and the planet.

About Murex

Murex provides enterprise-wide, cross-asset financial technology solutions to sell-side and buy-side capital markets players. With more than 60,000 daily users in 65 countries, its cross-function platform, MX.3, supports trading, treasury, risk, post-trade operations, as well as end-to-end investment management operations for private and public assets. This helps clients better meet regulatory requirements, manage enterprise-wide risk, and control IT costs. Learn more at www.murex.com.

OpenGamma is a derivatives analytics firm with expertise in over-the-counter and exchange-traded derivatives margin methodologies, backed by CME, JSCC, Accel and Dawn. It is trusted by large and sophisticated global banks, trading firms and fund managers, with thousands of users depending on its analytics.

Eurex is the leading European derivatives exchange and – with Eurex Clearing – one of the leading central counterparties globally. Being architects of trusted markets characterised by market liquidity, efficiency and integrity, Eurex provides its customers with innovative solutions to seamlessly manage risk.

On the trading side, Eurex masterminds the most efficient derivatives landscape by pioneering ingenious products and infrastructures, as well as by building ‘smart’ into technology. Eurex is the centre of European equity and equity index markets, offering a global product range, operating the most liquid fixed income markets in Europe and featuring open and low-cost electronic access.

As central counterparty, Eurex Clearing builds trusted relationships with and among market participants, enabling effective risk management and delivering high efficiencies to clients.

Risk Live is one of the few events where banks and the buy side come together to thrash out the issues shaping the future of finance. The topics up for discussion this year look to be right on the money, from the ongoing challenge of alpha generation to the technologies the industry must adopt to succeed.

Andrés Choussy, CEO, Taiana

Contact us for a customised package

If you would like to discuss customised sponsorship packages for this event, please contact one of our global team member:

Contact us

Sponsorship enquiries

Antony Chambers

Publisher, Risk.net/FX Markets/WatersTechnology