Why sponsor

Why sponsor

2025 Sponsors

Principal Sponsor

Founded by a group of industry experts, ActiveViam understands the data analytics challenges faced by financial institutions across trading desks, risk, and compliance. That is why we pioneered the use of high-performance analytics in finance, helping the largest investment banks, asset managers and hedge funds make better decisions, explain results with confidence, and simulate the impact of their decisions.

Our mission is to deliver train-of-thought analysis on terabytes of data in the most cost-effective way so our customers can explain their results with confidence and model the scenarios that will optimize their business. We are a pure player specializing in risk data analytics for one of the fastest moving and most regulated industries with a presence in the world’s leading financial marketplaces: London, New York, Singapore, Sydney, Hong Kong, Paris, and Frankfurt.

ActiveViam are also the proud winners of the Best use of cloud and FRTB product of the year at the Risk Market Technology Awards 2024.

For more information please visit: www.activeviam.com

Lead Sponsor

ServiceNow makes the world work better for everyone. Our cloud-based intelligent platform helps digitise and unify organisations to drive smarter, faster ways to address evolving risks, vulnerabilities, and compliance challenges. Power your resilient enterprise with risk-informed decisions embedded in daily work. Connect the business, security, and IT to manage risk and resilience in real time.

Panel Sponsor

KWA Analytics is a consultancy with a focus on and experience in implementing trading, risk and treasury management solutions. It is experienced in implementations, upgrades and solution architecture across a range of organisations, and has established itself as a trusted implementation consulting services provider.

2024 Sponsors

Lead Sponsors

Milliman is among the world’s largest providers of actuarial, risk management, and related technology and data solutions. With over 60 offices around the globe, our consulting and advanced analytics capabilities encompass the fields of healthcare, property and casualty insurance, life insurance, financial services, and employee benefits. Our breadth of expertise and data solutions provide insight into the interplay between physical, health, and economic risks, as well as the ability to communicate those risks and inform key decisions for governments, communities, and businesses around the world.

Beacon Platform is a financial technology firm that provides everything quantitative developers need to rapidly build, test, deploy and share trading and risk applications, analytics and models. Its platform addresses a wide range of needs, from energy and commodity trading to portfolio and multi-asset management, backed by the foundational components needed for a comprehensive view of risk and performance across all assets.

Founded by a group of industry experts, ActiveViam understands the data analytics challenges faced by financial institutions across trading desks, risk, and compliance. That is why we pioneered the use of high-performance analytics in finance, helping the largest investment banks, asset managers and hedge funds make better decisions, explain results with confidence, and simulate the impact of their decisions.

Our mission is to deliver train-of-thought analysis on terabytes of data in the most cost-effective way so our customers can explain their results with confidence and model the scenarios that will optimize their business. We are a pure player specializing in risk data analytics for one of the fastest moving and most regulated industries with a presence in the world’s leading financial marketplaces: London, New York, Singapore, Sydney, Hong Kong, Paris and Frankfurt.

For more information please visit: www.activeviam.com

Experiential sponsor

KWA Analytics is a consultancy with a focus on and experience in implementing trading, risk and treasury management solutions. It is experienced in implementations, upgrades and solution architecture across a range of organisations, and has established itself as a trusted implementation consulting services provider.

Panel Sponsors

Sustainalytics, a Morningstar Company, is a leading ESG research, ratings and data firm that supports investors around the world with the development and implementation of responsible investment strategies. For more than 25 years, the firm has been at the forefront of developing high-quality, innovative solutions to meet the evolving needs of global investors. Today, Sustainalytics works with hundreds of the world's leading asset managers and pension funds who incorporate ESG and corporate governance information and assessments into their investment processes. Sustainalytics also works with hundreds of companies and their financial intermediaries to help them consider sustainability in policies, practices and capital projects. With 16 offices globally, Sustainalytics has more than 800 staff members, including more than 300 analysts with varied multidisciplinary expertise across more than 40 industry groups.

Parameta Solutions is the data and analytics division of TP ICAP Group PLC, the world’s leading wholesale market intermediary, with a portfolio of businesses that provide a number of services, including over-the-counter (OTC) derivatives broking services.

OTC markets cater to innovation and accessibility. They offer a valuable alternative to traditional exchanges, creating a broader investment landscape. Unlike traditional exchanges which have central locations, OTC markets operate electronically through broker-dealer networks. This decentralised approach opens doors to a broader range of investment opportunities and also gives our clients access to a vast pool of the rare and scare data produced in these markets.

We work collaboratively with our clients to deliver this data, and innovative solutions build on this data, to help them create value, optimise capital and manage their risk.

In a world shaped by increasingly interconnected risks, Moody’s data, insights, and innovative technologies help customers develop a holistic view of their world and uncover opportunities. With a rich history of experience in global markets and a diverse workforce in more than 40 countries, Moody’s gives customers the comprehensive perspective needed to act with confidence and thrive. www.moodys.com

S&P Global Market Intelligence integrates financial and industry data, research and news into tools that track performance, generate alpha, identify investment ideas, understand competitive and industry dynamics, perform valuation and assess credit risk. It offers investment professionals, government agencies, corporations and universities the intelligence essential to make business and financial decisions with conviction.

ABOUT ACADIA

Acadia is a leading industry provider of integrated risk management services for the derivatives community. Our risk, margin and collateral tools enable a holistic risk management strategy on a real-time basis within a centralized industry standard platform.

Acadia’s comprehensive suite of analytics solutions and services helps firms manage risk better, smarter, and faster, while optimizing resources across the entire trade life cycle. Through an open-access model, Acadia brings together a network of banks and other derivatives participants, along with several market infrastructures and innovative vendors.

Acadia is used by a community of over 3,000 firms exchanging more than $1 trillion of collateral on daily basis via its margin automation services. Acadia is headquartered in Norwell, MA and has offices in Boston, Dublin, Dusseldorf, London, New York, Manila, and Tokyo. Acadia® is a registered trademark of AcadiaSoft, Inc.

Acadia is an LSEG Business within the Post Trade division. For more information, visit acadia.inc. Follow us on Twitter and LinkedIn

About Murex

Murex provides enterprise-wide, cross-asset financial technology solutions to sell-side and buy-side capital markets players. With more than 60,000 daily users in 65 countries, its cross-function platform, MX.3, supports trading, treasury, risk, post-trade operations, as well as end-to-end investment management operations for private and public assets. This helps clients better meet regulatory requirements, manage enterprise-wide risk, and control IT costs. Learn more at www.murex.com.

SureStep is a global advisory and implementation leader in the GRC and ESG fields. As an advisor to some of the world’s most influential companies, SureStep offers expertise, guidance, and solutions to organizations seeking to enhance their GRC and ESG practices. The company provides implementation/optimization services for solutions from CUBE, Supply Wisdom, IBM (OpenPages and Envizi), Diligent and Data Sentinel.

Kingland is a leading provider of enterprise-class software using a suite of products and teams of data and technology experts. The world's largest stock exchanges, financial institutions, public accounting firms, and other Fortune 500 companies use Kingland Products for data management, risk management, regulatory compliance, & data refinement. Since 1992, Kingland has helped data-intensive, highly-regulated clients discover new ways to securely grow their business and protect their reputation.

CUBE is the world’s most comprehensive and robust source of classified, and meaningful AI-driven regulatory intelligence. CUBE’s purpose-built regulatory AI engine (RegAI) and tech platform (RegPlatform) tracks, analyses, and monitors laws, rules and regulations in every country and in every published language to create an always up to date regulatory footprint, mapping these according to data, transforming visibility and compliance capability.

With operations across Europe, North America, Asia, and Australia, CUBE serves a diverse and global base of customers and partners including the largest financial institutions in the world who leverage CUBE’s RegPlatform to streamline their complex regulatory change management and compliance processes. Whether you’re a large, multinational bank, or a small financial organization with up to a handful of compliance officers, we’ve got a suite of products tailored to you.

MSCI is a leading provider of critical decision-support tools and services for the global investment community. With over 50 years' expertise in research, data and technology, MSCI powers better investment decisions by enabling clients to understand and analyse key drivers of risk and return, and to confidently build more effective portfolios. MSCI creates industry-leading research-enhanced solutions that clients use to gain insight into and improve transparency across the investment process.

Fraud is inevitable. Instnt's AI reduces fraud risks and transfers residual losses to the insurance market through a unique partnership with global A-rated insurers, saving businesses millions in operational and treasury costs.

Bloomberg is a global leader in business and financial information, delivering trusted data, news, and insights that bring transparency, efficiency, and fairness to markets. The company helps connect influential communities across the global financial ecosystem via reliable technology solutions that enable our customers to make more informed decisions and foster better collaboration.

ServiceNow makes the world work better for everyone. Our cloud-based intelligent platform helps digitise and unify organisations to drive smarter, faster ways to address evolving risks, vulnerabilities, and compliance challenges. Power your resilient enterprise with risk-informed decisions embedded in daily work. Connect the business, security, and IT to manage risk and resilience in real time.

Exhibitor Sponsors

Opensee is an award-winning technology company that provides financial institutions with a real-time self-service data management and data analytics platform, run on any cloud, on-premise, or hybrid cluster.

Created by capital markets experts, Opensee's solutions cover a wide range of risk, finance and trade use cases. With unrivaled time to value and performance/cost ratio by combining high-performance computing with AI, the company allows banks, asset managers and hedge funds to build any size domain-specific data referentials, setting a new bar for hyper-fast aggregation, calculation and simulations across any data volume and model complexity.

Opensee allows financial institutions to not only achieve data explainability but also to do so in a way that is cost-effective, performance-driven and adaptable to real-time requirements. This empowers efficient decision-making, regulatory compliance and streamlined risk management.

With offices in London, Paris, New York and Singapore, Opensee is proud to work with a trusted client base across global Tier 1 banks, asset managers, hedge funds and trading platforms.

Learn more at opensee.io.

CRISIL is a global analytics company driven by its mission of making markets function better by offering services in the Risk, Research, Ratings, Analytics and Consulting space to global financial institutions (FIs). We are partners to 200+ of the world’s biggest FIs. These include 15 of the top 20 leading global investment banks, 100+ global buy-side firms including private equity firms, hedge funds and wealth managers, and five leading global insurers. Several systemically important FIs have leveraged our high-end risk and analytics, and bespoke research services over the past 20 years.

Our suite of innovative, technology-driven risk management solutions is crafted to expedite regulatory and internal compliance for FIs. These tools enable informed decision-making and deliver substantial cost efficiencies.

CRISIL has delivered independent opinions, actionable insights and efficient solutions to 100K+ customers through businesses that operate from the United States (US), the United Kingdom (UK), India, Argentina, Poland, China, Colombia, Singapore, Australia, Switzerland, Japan and the United Arab Emirates (UAE).

To know more, visit www.crisil.com.

Associate Sponsors

MarketAxess (Nasdaq: MKTX) operates a leading electronic trading platform that delivers greater trading efficiency, a diversified pool of liquidity and significant price improvements to institutional investors and broker-dealers across the global fixed-income markets. Over 2,000 firms leverage MarketAxess’ patented technology to efficiently trade fixed-income securities. MarketAxess’ award-winning Open Trading® marketplace is widely regarded as the preferred all-to-all trading solution in the global credit markets. Founded in 2000, MarketAxess connects a robust network of market participants through the full trading lifecycle, including automated trading solutions, intelligent data products and a range of post-trade services.

Transform business risk into strategic advantage with AverQ. Our AI-powered Unified Risk Apps platform provides advanced solutions across all lines of defense, with over 300+ deployments worldwide. Designed specifically for financial services, AverQ delivers sophisticated, client tailored solutions for Internal Audit, Regulatory Compliance, Operational Risk, Third-party Vendor Management, and more. Unlike generic workflow systems, AverQ’s SaaS platform centralizes and unifies entity definitions, policies, and controls, offering highly configurable workflows, interactive dashboards, and built-in infographics to foster enterprise-wide collaboration and proactive risk mitigation.

MetricStream is a global software-as-a-service leader of integrated risk management and governance, risk and compliance (GRC) solutions that empower organisations to thrive on risk by accelerating growth via risk-aware decisions. It connects governance, risk management and compliance across the extended enterprise. MetricStream's ConnectedGRC and three product lines – BusinessGRC, CyberGRC and ESGRC – are based on a single, scalable platform that supports clients on their GRC journeys. For more information, visit www.metricstream.com.

Behavox is an Artificial Intelligence company on a mission to build cutting-edge AI systems that safeguard businesses and enhance human productivity. As the world’s foremost provider of AI-powered archiving, compliance, and security solutions, we are trusted by leading organizations to secure their text and voice communications data, and monitor a broad range of regulatory, conduct, and insider threat risks. Founded in 2014, Behavox is headquartered in London, with offices worldwide, including in New York City, Montreal, Seattle, Singapore, and Tokyo.

Co-Sponsor

Credit Benchmark provides Credit Consensus Ratings and Analytics based on contributed risk views from 40+ of the world’s leading financial institutions, almost half of which are GSIBs, domiciled in the US, Continental Europe, Switzerland, UK, Japan, Canada, Australia and South Africa.

The risk views are collected, aggregated, and anonymized to provide an independent, real-world perspective of credit risk, delivered twice monthly to our clients. Credit Consensus Ratings and Analytics are available on 105,000+ corporate, financial, fund and sovereign entities globally, most of which are unrated by credit rating agencies. Credit Benchmark also produces 1,200 credit indices, which help risk practitioners better understand industry and sector macro trends.

Risk professionals at banks, insurance companies, asset managers and other firms use the data to gain visibility on entities without a public rating, inform risk sharing transactions (CRT / SRT), monitor and be alerted to changes within the portfolio, benchmark, assess and analyze trends, and fulfil regulatory requirements and capital.

Visit www.creditbenchmark.com to learn more.

Media Partners

Designed and delivered by industry experts and thought leaders, Risk Learning covers a range of topics across risk management, derivatives and complex financial markets. Risk Learning courses reflect the latest industry developments, regulatory updates and best practices. Access the most up-to-date knowledge and practical insights to prepare yourself, your team and your organisation for real-world challenges.

Risk Books has been a world leader in specialist books on risk management and the financial markets for over 20 years. Risk Books is proud to be a niche publisher that has quality as its top priority.

Our mission is to produce books that truly add value by delivering the very best information on our specialist subjects. And with more than 180 different titles currently in print, Risk Books covers a wide range of technical subjects for academics, practitioners, investors and corporate users - ranging from derivatives, hedge funds, quant analysis, credit, regulatory issues and operational risk to the energy, insurance and currency markets – with books for experts and scholars alike.

Risk Journals deliver academically rigorous, practitioner-focused content and resources for the rapidly evolving discipline of financial risk management.

Each quarter, Risk Journals provide peer-reviewed research and technical papers, delivered to a global audience in print and online. The Risk Journals portfolio has been serving, broad and international readership communities that bridge academia and industry for over 25 years. The mission of Risk Journals is to equip readers with the tools to fulfil their professional potential.

Risk Journals publishes original and innovative papers, ensuring subscribers are kept up-to-date with the ever-changing complexity behind the science of risk management.

Risky Women® is a global network connecting, celebrating and championing women in risk, regulation, and compliance. Providing a voice for the female perspective of our rapidly growing, changing, and influential industry. We strive to bring together women shaping the debate and the industry.

Powered by Risk.net this community helps senior leaders in banks better achieve their strategic objectives. Our unique position in the industry meant that we were regularly told how isolating it can be at the top when making important decisions. The network bridges this gap by enabling members to talk through complex risk-related problems with peers who understand.

Interested in joining? Submit your details

Annual membership grants you access to:

- Bespoke roundtables: Select your priorities at point of onboarding. We then match you with leaders who have similar areas of interest.

- In-person networking: We understand the importance of face-to-face networking that's why we organise regular meet-ups with fellow members.

- Network radar: Regular insights from across the network, highlighting other members’ priorities, meeting topics and takeaways.

Supporting association

The Global Association of Risk Professionals is a non-partisan, not-for-profit membership organization focused on elevating the practice of risk management. GARP offers the leading global certification for risk managers in the Financial Risk Manager (FRM®), as well as the Sustainability and Climate Risk (SCR®) Certificate and ongoing educational opportunities through Continuing Professional Development. Through the GARP Benchmarking Initiative (GBI)® and GARP Risk Institute (GRI), GARP sponsors research in risk management and promotes collaboration among practitioners, academics, and regulators.

Founded in 1996 and governed by a Board of Trustees, GARP is headquartered in Jersey City, N.J., with offices in London and Hong Kong.

For more information, visit garp.org or follow GARP on LinkedIn, Facebook, and X (formerly Twitter).

The numbers that matter

35

states represented

400

senior decision-makers

120

speakers

4

content-led stages

Our audience

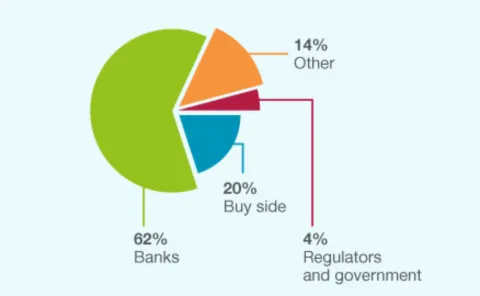

Industry breakdown

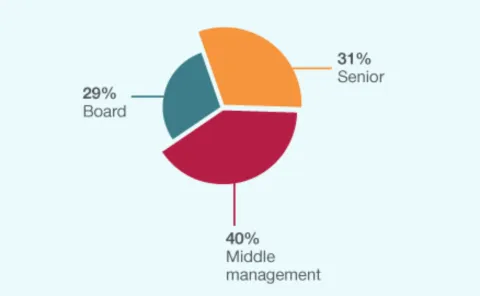

Seniority breakdown

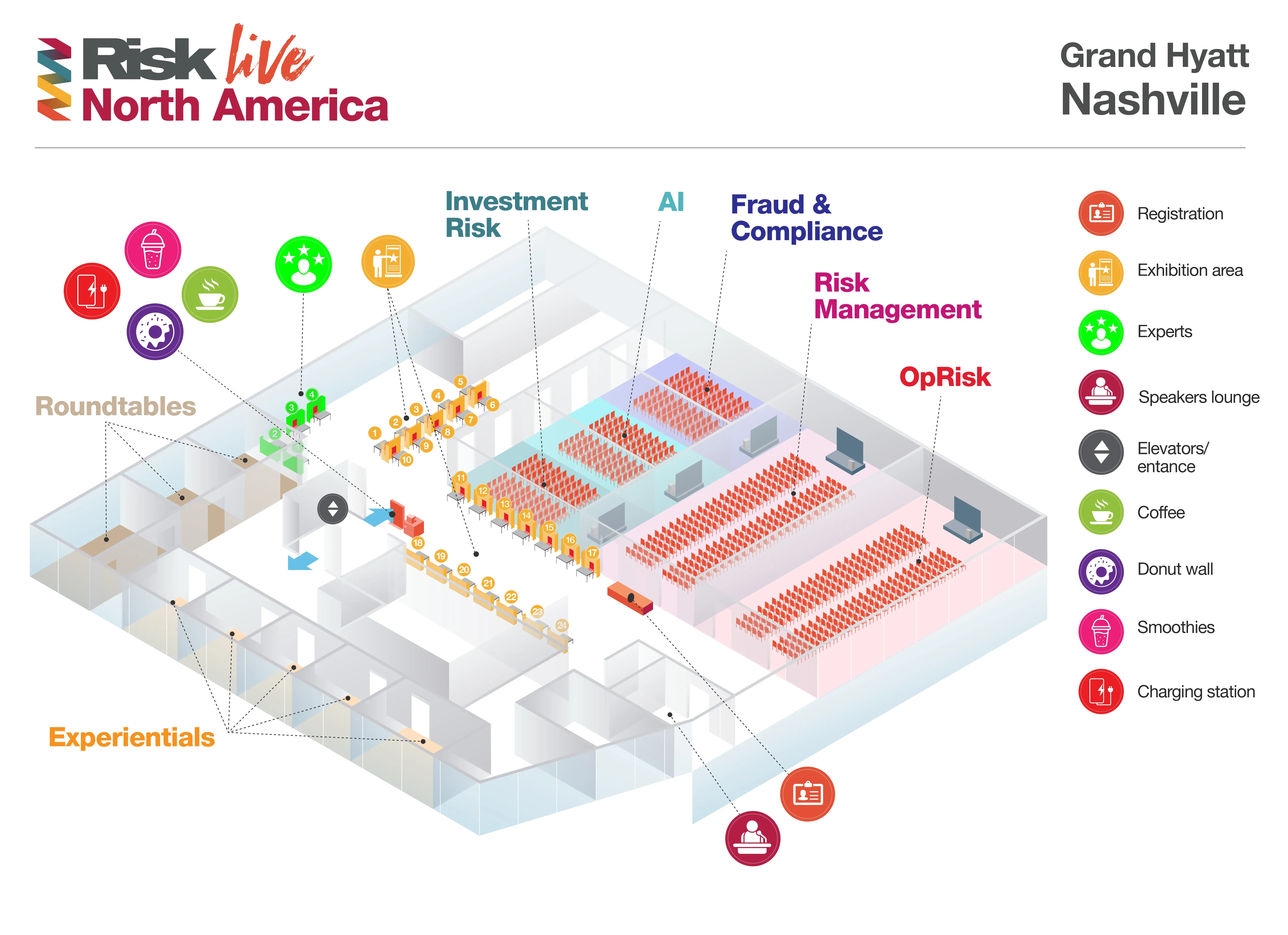

*Please note that the above floorplan is not to scale and is for illustrative purposes only.

Reserve your booth now

Why partner with Risk Live North America?

Connect with senior risk professionals

Our engaged attendees, senior decision-makers, come from diverse financial institutions, such as banks, asset managers, insurers, and regulators.

Increase brand visibility

Maximise networking with potential clients, boost online brand visibility, and utilize Risk.net’s event app for seamless collaboration opportunities.

Participate in enriching discussions

Partners can showcase their expertise and thought leadership on key industry topics through speaking opportunities and targeted content.

Return on investment

We offer packages to maximise value for your investment, with a range of benefits tailored to meet your specific needs and objectives.

Interested in sponsoring? Contact us today

Sponsorship enquiries

Marcel Chambers

Head of Americas sales and client development

TEL: (646) 755-7253